by healthcaredeciphered | Sep 13, 2015 | Deciphering Healthcare

While the healthcare industry has made significant strides in decreasing the number of people who are uninsured, thousands of Americans remain  underinsured, an estimate 31 million If you are underinsured, it means you are paying more for healthcare than you can afford, even if you are currently enrolled in a health insurance plan. (more…)

underinsured, an estimate 31 million If you are underinsured, it means you are paying more for healthcare than you can afford, even if you are currently enrolled in a health insurance plan. (more…)

by healthcaredeciphered | Sep 2, 2015 | Blog, Deciphering Healthcare

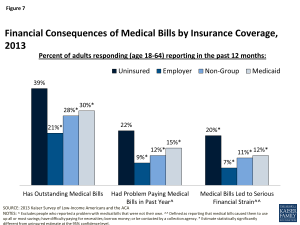

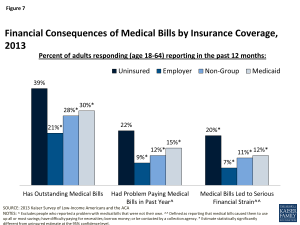

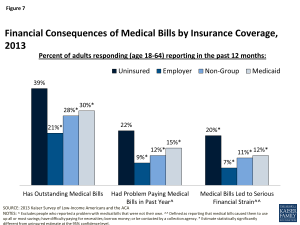

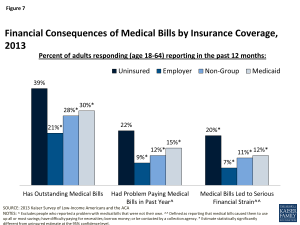

While having medical insurance is important; however, being underinsured is actually a larger problem. In 2014, 31 million Americans are underinsured, with the majority resulting from employer-based health plans. According to The Commonwealth Fund, the number of underinsured has remained unchanged, since 2014. Likely, this trend will continue.

What is Underinsured?

Underinsured people have health insurance, but cannot afford the out-of-pockets costs, such as deductible, co-payments, co-insurance, etc. It is financially detrimental to continue with health services under their health plan’s benefit structure.

Technically, underinsured is measured by meeting one of the following criteria:

- Out-of-pocket costs, excluding premiums, over the prior 12 months are equal to 10 percent or more of household income

- Out-of-pocket costs, excluding premiums, are equal to 5 percent or more of household income if income is under 200 percent of the federal poverty level ($22,980 for an individual and $47,100 for a family of four)

- Deductible is 5 percent or more of household income

The astonishing part is 13% of privately insured adults have deductibles equal to 5%+ of their income (The Commonwealth, 2015). If your income is $50,000, most likely your deductible is at least $2,500, which must be paid in full prior to using most healthcare services. Deductibles are designed to keep you from only using health services that are needed, but more often high deductible plans deter patients from obtaining critical or needed care.

Why do you pay a premium for health insurance that is too expensive to use? Based on 2014, half of Americans earning on average $50,000 to $95,000 stated it was difficult to afford their deductibles. Of this same group, 21% skipped prescriptions or delayed care due to healthcare expenses, even though they had health insurance.

Can you afford your healthcare costs? Find out in our next posting how to determine if you are underinsured?

by healthcaredeciphered | Jul 2, 2015 | Blog, Deciphering Healthcare

Do you need health insurance for your company or maybe your current insurance isn’t  cutting it? In this article, you will find the best health insurance plans for small businesses to suit any combination of employees’ benefit needs. Here at Healthcare Deciphered, we used our expertise to rank plans according to several criteria, which we believe to be most important: affordability, plan variety, member benefit selection, and wellness incentives. (more…)

cutting it? In this article, you will find the best health insurance plans for small businesses to suit any combination of employees’ benefit needs. Here at Healthcare Deciphered, we used our expertise to rank plans according to several criteria, which we believe to be most important: affordability, plan variety, member benefit selection, and wellness incentives. (more…)

by healthcaredeciphered | Jun 30, 2015 | Blog, Deciphering Healthcare

Do you think you pay too much for health insurance? This might be the case. How can you know for sure? Below is a list of indicators that could be driving up how much you spend on healthcare each year. If yo ur health plan includes any of the below “benefits”, it might be time to re-evaluate. These indicators could explain the overwhelming aggravation, expensive physician bills, and the confusion you feel while attempting to navigate the system. (more…)

ur health plan includes any of the below “benefits”, it might be time to re-evaluate. These indicators could explain the overwhelming aggravation, expensive physician bills, and the confusion you feel while attempting to navigate the system. (more…)

by healthcaredeciphered | Jun 16, 2015 | Blog, Deciphering Healthcare

Health insurance premiums for 2016 are on the rise. Yesterday, w e posted a blog on the difficulties of reducing healthcare costs. It has been hard for universal or single payer healthcare systems to keep costs low and Affordable Care Act is no exception. The exchange health insurance plans, which vary by state, will have increasing premiums for 2016. The amount of the increase is unclear as no specific figures have been released.

e posted a blog on the difficulties of reducing healthcare costs. It has been hard for universal or single payer healthcare systems to keep costs low and Affordable Care Act is no exception. The exchange health insurance plans, which vary by state, will have increasing premiums for 2016. The amount of the increase is unclear as no specific figures have been released.

However, Avalere reported that the average increase could be as high as 5.8% for the silver plans*. These projected cost increases could have a significant economic impact as the majority of Americans who enrolled in the healthcare exchange selected silver plans. The other plans under the exchange are gold and bronze, which will have premium adjustments for 2016 too

Again, the increase at this point has yet to be determined. For the majority of Americans who selected the silver plans, let’s hope the final rates are much lower.

If you enrolled in a state exchange health plan, please ask us how this will affect you. In order to keep premiums low, you may need to switch plans for 2016.

Footnote: In the marketplace, the plans are listed hierarchically: gold, silver, and bronze. Major distinctions include premium price, cost of deductible, and benefits included.

Read more: Health Insurance Premiums Will Go Up In 2016, But By How Much?

by healthcaredeciphered | Jun 14, 2015 | Blog, Deciphering Healthcare

Since 2011, Vermont has held the distinction of both designing and implementing the best healthcare system in the country. The single payer option seemed to make the most sense to policymakers d ue to the state’s small population and low levels of economic inequality. In other words, there was a small amount of people that shared, more or less, the same socioeconomic status. Early reports in 2011 marked the successful implementation of the healthcare model, which was shared around the county as the “solution” for our healthcare industry problems. However, it only lasted 4 years. (more…)

ue to the state’s small population and low levels of economic inequality. In other words, there was a small amount of people that shared, more or less, the same socioeconomic status. Early reports in 2011 marked the successful implementation of the healthcare model, which was shared around the county as the “solution” for our healthcare industry problems. However, it only lasted 4 years. (more…)

underinsured, an estimate 31 million If you are underinsured, it means you are paying more for healthcare than you can afford, even if you are currently enrolled in a health insurance plan. (more…)

underinsured, an estimate 31 million If you are underinsured, it means you are paying more for healthcare than you can afford, even if you are currently enrolled in a health insurance plan. (more…)